How to Change the Language on Facebook in a Few Simple Steps

Ever wondered how to make Facebook speak your language—literally? You're in the right place. Changing the language on Facebook isn't just a matter of...

How Much Data Does Amazon Prime Video Use

Are you a fan of Amazon Prime Videos? Have you recently subscribed to Amazon Prime? Well, you should know how much data your Prime...

Do I Need CCleaner on My Android Phone?

CCleaner has been a trusted name in the world of PC and Mac cleaning software for years. Now, they've brought their expertise to the...

How to Access and Manage Your Clipboard on Android: A Complete Guide

Clipboard Manager helps a user to improve their copy-paste functionality on their Android device. Copying and pasting on a smartphone is pretty easy. You...

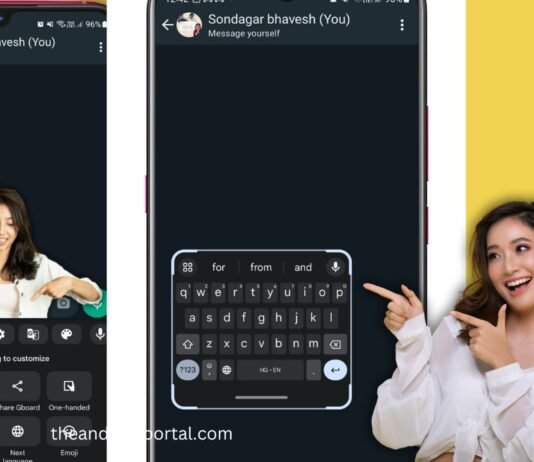

How To Fix Whatsapp Voice Messages Not Working Issue?

The WhatsApp voice messages not working issue is now fixed! Read this post till the end for the complete solution.

Whatsapp is one of the...

How Much Data Does Netflix Use On Android

We are living in a new generation. Many people use the Netflix app. The Netflix app requires more data to show your video. We...

How Much Data does Google Maps Use

Google Maps is a web mapping service developed by Google. It offers satellite imagery, aerial photography, street maps, 360° interactive panoramic views of streets...

How to Uninstall Hotstar App on Samsung Smart TV

Uninstalling apps from my Samsung Smart TV has always seemed like a breeze, but uninstalling it from my TV felt like the right move.

In...

How to Fix Snapchat Notifications Not Working

Snapchat is one of the most popular messaging apps out there. It allows you to send fun messages and pictures to your friends, but...

How to Cancel YouTube Premium on Android

The YouTube scene in India has skyrocketed since the introduction of the Jio SIM card. With nearly everyone sporting a Jio SIM for unlimited...